The COVID-19 shutdowns were a gift that keeps on giving. It shouldn’t have surprised anyone to learn that the mass exclusion of workers (Mistake #1), causes economic collapse. Democrats managed to ride the chaos to the office and used their Washington power and gave grants and loans at will, “rescuing” the economy by flooding it with additional trillions of dollars that were not tied to any particular value, (Mistake #2). Nobody should have been surprised to see the rampant inflation which followed and continues to plague all except the very wealthy.

The Federal Reserve System has raised interest rates in order to control inflation. This is done by increasing the money supply. This can often lead to a recession and suppress growth. After a major economic disruption, the dream is to have a “soft landing”, where inflation falls without the higher rates crushing GDP. This dream is often a pipe dream. This is now the case.

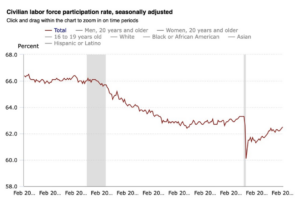

One thing is that employment levels are still far below pre-shutdown levels. Biden may brag about low unemployment all the time, but it is true that only 62.5% of working-age people are actually interested in work. The U.S. Bureau of Labor Statistics has this chart:

Businesses have been unable to invest and grow due to the Fed’s inexorable rate-raising. Some businesses have difficulty making payroll due to persistent inflation. The bank collapse rollercoaster ride we’re on since last week was also influenced by steadily rising rates. The administration used its favorite cure-all to stop the dominoes falling under its watch: money. (Yes, inflation is still killing us and yes, those red alert klaxons are you hear going off).

The Fed created the Bank Term Funding Program, (BTFP), to provide a “backstop” — a guarantee that banks will have liquidity if they are forced into insolvency due to the yield inversion resulting from rate increases. They could also pay deposits out as necessary. Big Government unilaterally decided that it would bail out all the deposits of Silicon Valley Bank and Signature Bank, in addition to the $250,000 guarantee by FDIC. This was in accordance with a systemic risk exemption.

Since the disastrous COVID-19 shutdown, and the Democrat-led takeover of the federal government, government loans, and outright giveaways were a common occurrence. These policies not only sandbag ordinary Americans with historical inflation but also make it difficult for the Fed raise rates meaningfully while simultaneously devaluing cash.

(I must note that almost all of these bailouts somehow always seem to benefit the progressive, white-collar class — college debt carriers, Silicon Valley bigwigs, venture capitalists, and their celebrity peers like Harry and Meghan, who deposit their Netflix millions alongside them.)

Joe Weisenthal, Bloomberg’s Thursday morning email editor, summarised the dire situation in which we find ourselves now:

The last week has seen central banks in a difficult spot. They have been warning of plans to increase rates for a long time, despite high inflation. However, financial stability in Europe and the US is now at risk.

The Fed (which will make a decision next Wednesday) and the ECB, which have a decision this morning, must decide which path is riskier. Stop and you risk inflation gaining steam. Continue to hike and you risk an inflationary meltdown.

We wouldn’t be here if the Leftist dictators hadn’t closed down our economy and given us wads upon wads of cash. We are now dependent on federal over-management, and bailouts, damned when we raise rates and damned when we don’t.

There is nowhere to go so it’s not surprising that these people are looking for a good old-fashioned war.